- Home

- CDP Mass Share Transfer Request

Transfer-in & Get Rewarded

Transfer in your CDP Holdings at

ZERO Fees & Get Rewarded up to S$1,888!

Transfer-in &

Get Rewarded

Transfer in your CDP Holdings at ZERO Fees & Get Rewarded up to S$1,888!

Exclusive Promotion

Enjoy the following Cash Credit rewards when you transfer in:

*T&Cs Apply.

Invest Smarter. Partner with an Investment Specialist.

Receive expert advice on

trading and corporate actions

Tap onto years of

stock market experience

Accumulate your wealth with

a closely monitored portfolio

Receive customised strategies

that align with your goals

How to Get Started!

- Cash Management

- Cash Trading

- Custodian

- Prepared Custodian

- Cash Plus

- Margin

- Cash Management

- Cash Trading

- Custodian

- Prepared Custodian

- Cash Plus

- Margin

Launch Into WAIVED Fees Now!

| CDP Share Transfer Fee | Waived |

| Dividend Handling Fee (SGX-listed Securities) | Waived |

| Corporate Action Fee (SGX-listed Securities) | Waived |

| Account Maintenance Fee | Waived |

| Foreign Share Custody Fee | Waived |

| *Applicable to participants of cdp mass shares transfer page | |

| Fee Waiver Table (Applicable to Participants of CDP Mass Share Transfer Request) | |

| CDP Share Transfer Fee | Waived |

| Dividend Handling Fee (SGX-listed Securities) | Waived |

| Corporate Action Fee (SGX-listed Securities) | Waived |

| Account Maintenance Fee | Waived |

| Foreign Share Custody Fee | Waived |

*Applicable to participants of cdp mass shares transfer page

Until 30 Sep 2027

Get in touch with your Investment Specialist now!

Don’t have one? Contact us at 65311555 or talktophillip@phillip.com.sg

Why Build a Portfolio with Us

Founded in 1975, with one of

the largest pools of Investment Specialists in Singapore today

Receive a comprehensive range of Financial Services from our multi-licensed Investment Specialists.

(E.g. Licences in both portfolio management and financial advisory)

24/7 access to your portfolio

via POEMS

Stay one step ahead with

Real-time Market Insights

Freuquent Asked Questions

Only Cash Management, Cash Trading, Custodian, Prepaid Custodian, Cash Plus or Margin Accounts are eligible. Upon submitting the Request, Cash Management or Cash Trading Accounts will be converted to Custodian Account.

Only SGX-listed securities (e.g. shares, ETFs and bonds) and T-bills are eligible to be transferred in.

Below is a list of securities that are not eligible for the transfer:

- Rights Shares

- Singapore Saving Bonds

- Securities that are in “Blocked” status (e.g. Moratorium, Charge)

- Securities that are on loan as part of SGX SBL programme

- Unlisted counters

- Suspended counters

The CDP Mass Share Transfer Request is optional. If you choose not to submit this Request, you will continue trading with your CDP-linked account (i.e. Cash Management, Cash Trading).

No, Estate accounts are not eligible for the Request.

Yes, Corporate accounts are eligible for the Request. No change in beneficiary owner is allowed.

Yes, Joint Accounts are eligible for the Request. No change in beneficiary owner is allowed.

Our customers’ monies and assets (including those assets that are held with appointed foreign custodians) are safe-kept in accounts which are designated as trust accounts for customers in compliance with the MAS’ requirements under the Securities and Futures Act (“SFA”) and Securities and Futures (Licensing and Conduct of Business) Regulations. Customers’ monies and assets are protected by keeping them in customer segregated accounts separate from PSPL’s own.

Section 104A of the SFA also provides that monies and assets belonging to customers are not available for payment of PSPL’s debts and shall not be liable to be paid or taken in execution under an order or a process of any court.

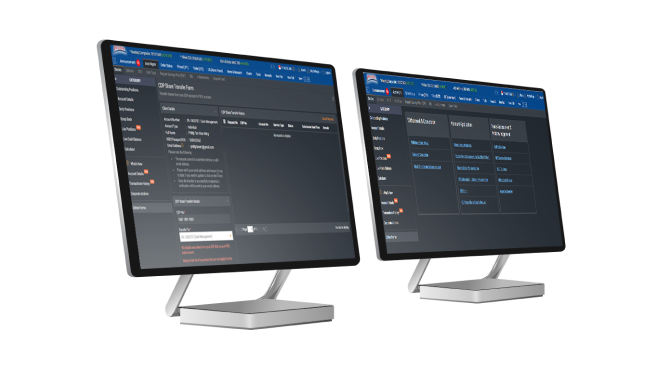

You must opt-in for the transfer-in via login to POEMS Website at www.poems.com.sg.

Go to Account Mgmt > Stock > Online Form > Account Application> CDP Mass Share Transfer Request.

No. You must log in to the POEMS website and agree to the terms and conditions in order to proceed with the Request.

No, you can only transfer all your securities and T-bills from one CDP account to one POEMS Account, namely Cash Management*, Cash Trading*, Custodian, Prepaid Custodian, Cash Plus, and Margin Account.

*Upon submission of the CDP Mass Share Transfer Request, Cash Management or Cash Trading Accounts will be converted to a Custodian Account. Learn more about Custodian Accounts here.

No, you can only transfer shares from your individual CDP account to an individual POEMS Account or Joint CDP to Joint POEMS Account. No change in beneficiary ownership is allowed.

Yes, you will need to specify which POEMS account will be the recipient of the CDP Mass Share Transfer Request during the submission process. If you select either a Cash Management or Cash Trading account, it will be converted to a Custodian Account.

Please click here for the table regarding fee waivers. Any fees accrued prior to the transfer will not be waived. For example, if there is an outstanding fee in the existing Custodian Account, the customer will still need to settle this fee.

The process for transferring shares back to CDP or to another broking firm may incur fees. Please refer to the link for Share Transfer Fees and procedures: https://www.poems.com.sg/share-bond-unit-trust-transfer/

Yes. Your POEMS Account numbers will remain the same.

There will be no change to existing brokerage rates, trading limits and contra facilities.

The GIRO linkage (if any) for the Cash Trading Account will be delinked after conversion. However, you can apply for EPS via POEMS login.

There will be no change to the payment arrangement.

The CDP linkage will be delinked from the Custodian Account but your CDP account will not be closed by CDP. Please note that you cannot sell new holdings kept with CDP unless you transfer the holdings into the Custodian Account again.

Yes, your CDP account will remain active. You can still purchase shares through other broking firms and keep the new holdings with CDP. However, you must remember to transfer the new holdings from CDP into your POEMS Account if you wish to sell the new holdings through us.

No, you can only sell your holdings via the same POEMS Account

You can continue to manage your assets that are not held under our custody and are able to apply for IPOs through the usual channels. However, allocation of shares will not be credited to your POEMS Account unless you initiate the Mass Share Transfer Request again.

You can view your holdings held under our custody via POEMS login.

To check your CDP holdings, login to the CDP portal.

For SGX-listed securities kept in your Custodian Account, there is a possibility of short-selling because our system will not check your local shareholdings in your accounts. However, you are unable to short-sell foreign shareholdings kept in your Custodian Account.

Yes, please refer here for more information: SGS (Singapore Government Securities) T-Bills, SGS Bonds, U.S. Treasury available in POEMS

Yes, you can cancel the Request before 4.30pm on the same day.

You will receive an email notification once the CDP Mass Share Transfer Request is completed.

The CDP Mass Share Transfer Request may take effect within 2 business days, provided you do not have any outstanding positions in your CDP Accounts. You will receive an email notification after the transfer Request has been completed

You can still submit the Request, but it will be sent to CDP for processing after all outstanding positions are closed.

Terms & Conditions

- The promotion is only valid for Customers who transfer in Eligible Assets from CDP fully to Eligible Accounts from 1 January 2026 to 31 March 2026, both dates inclusive.

- Customers who previously participated in our previous CDP Mass Share Transfer promotions will still be eligible to participate in this promotion again.

- Eligible Customers will receive Excess Funds Management SMART Park credit of:

- S$88 for transferring S$100,000 to S$199,999 worth of Eligible Assets

- S$188 for transferring S$200,000 to S$499,999 worth of Eligible Assets

- S$288 for transferring S$500,000 to S$999,999 worth of Eligible Assets

- S$588 for transferring S$1,000,000 to S$1,999,999 worth of Eligible Assets

- S$1,888 for transferring S$2,000,000 or more worth of Eligible Assets

- Eligible Assets are all SGX-listed securities (e.g. shares, ETFs and bonds) and T-bills.

- Customers are required to opt-in to the Excess Funds Management Facility (SMART Park) (SGD/USD) within 90 days of the submitted request.

- Eligible Accounts for submitting the CDP Mass Share Transfer Request include: Cash Management, Cash Trading, Custodian, Prepaid Custodian, Cash Plus, or Margin Account.

(Upon submitting the CDP Mass Share Transfer Request, Cash Management or Cash Trading Accounts will be converted to Custodian Accounts) - The total value of Eligible Assets transferred must be maintained in the Account for 90 calendar days from the shares transferred in-date.

- SMART PARK Credits will be credited before the end of July 2026.

- This Promotion is not applicable to PSPL and its associated entities and subsidiaries (direct or indirect), e.g. Staff and Trading Representatives.

- By taking part in the promotion, you agree and consent to PSPL sending relevant information to third-party service providers to facilitate the delivery and redemption of the Rewards.

- In the event of a dispute over the Customer’s eligibility to participate in this promotion, PSPL’s decision will be final.

- Notwithstanding anything herein contained, PSPL reserves the right at any time in its absolute discretion to (i) amend, add to, and/or delete these Terms and Conditions without prior notification (including eligibility; replacement of the prize; promotional mechanics, promotion duration without prior notification, qualifying terms and criteria), and all participants shall be bound by such amendments, additions and/or deletions when effected, or (ii) vary, withdraw, or cancel any items or the promotion without having to disclose a reason thereof and without any compensation or payment whatsoever. PSPL’s decision on all matters relating to the promotion shall be final and binding on all participants.

- This advertisement has not been reviewed by the Monetary Authority of Singapore.